Imagine walking into a bank where your financial advisor instantly recalls every conversation you’ve had, furnishes personalized insights based on your spending patterns, and fluently speaks your native language. It is not science fiction-but the reality generative AI is making a reality in retail banking today.

The AI Banking Revolution: By the Numbers

In retail banking, the adoption of generative AI is taking place at an unprecedented pace. As per Gartner, by 2026 more than 80% of the banks will have adopted Gen AI and estimated investments will reach $85 billion by 2025.

Such transformation will boost banking productivity by 20% and will significantly improve customer satisfaction.

Use Cases That Are Revolutionizing Banking

- Hyper-Personalized Financial Advisory

Generative AI is transforming how banks give financial advice. AI systems can create customized financial plans after analyzing vast amounts of data from the customers, transaction histories, and market trends.

Adaptive to changing customer circumstances, these strategies are updated real-time. JPMorgan Chase has succeeded in enhancing customer engagement with their wealth management platforms by up to 40% after adopting AI-driven advisory services.

Other major banks besides JPMorgan Chase have been reporting comparable improvements. The AI systems often predict life events that will affect financial planning, for example, a marriage or children’s education or retirement, often before customers ask for advice on them. This pre-emptive approach makes it easier to retain clients and increase assets under management.

It also democratizes access to sophisticated financial advice that was previously the preserve of high-net-worth individuals. Banks can now offer personalized advisory services to a broader customer base at a fraction of the traditional cost by automating many aspects of financial planning.

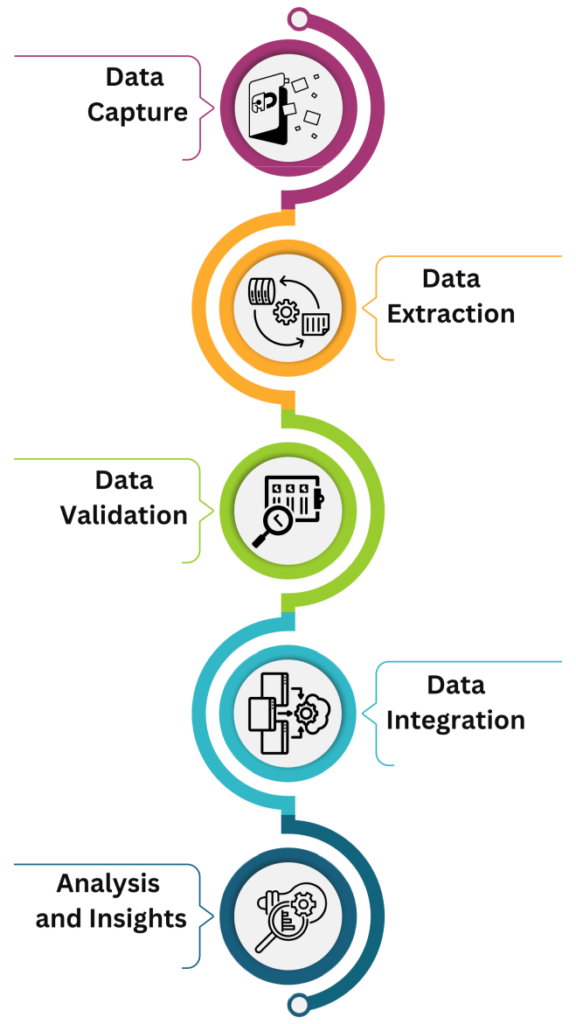

- Intelligent Document Processing

Banks are taking advantage of generative AI to automate the processing of complicated financial documents, ranging from loan applications to compliance reports.

Bank of America’s AI document processing system has reduced processing time by 75% while upping the accuracy rate to 99.9%, with more than 1.5 million documents processed every month.

Moreover, these AI systems can be integrated into existing banking workflows, automatically routing processed documents to relevant departments or flagging them for human review when necessary. This creates a seamless process that combines the efficiency of automation with human expertise where it’s most valuable.

The savings in costs are tremendous; in addition to processing speed, banks report substantial savings in operational costs. While some institutions have even realized as much as a 60% saving in document processing cost and maintains higher accuracy rates than with manual processing.

- Conversational Banking Excellence

Advanced language models power next-generation chatbots and virtual assistants capable of addressing complex customer queries with human-like understanding. The AI assistant from Wells Fargo has successfully answered 85% of customer queries on its own, reducing call center volume by 30%.

Conversational banking can work 24/7 to ensure support is accessible whenever a customer may need it. This cuts across time zones and business hours, thus a must in today’s world, which thrives at warp speed with the expectation of an instant response and seamless service.

These advanced tools are designed to aid clients in any language, enabling global accessibility and increasing client contentment levels. Customers may soon be able to communicate with AI in over 50% of contact centers using deep fake human-like agents.

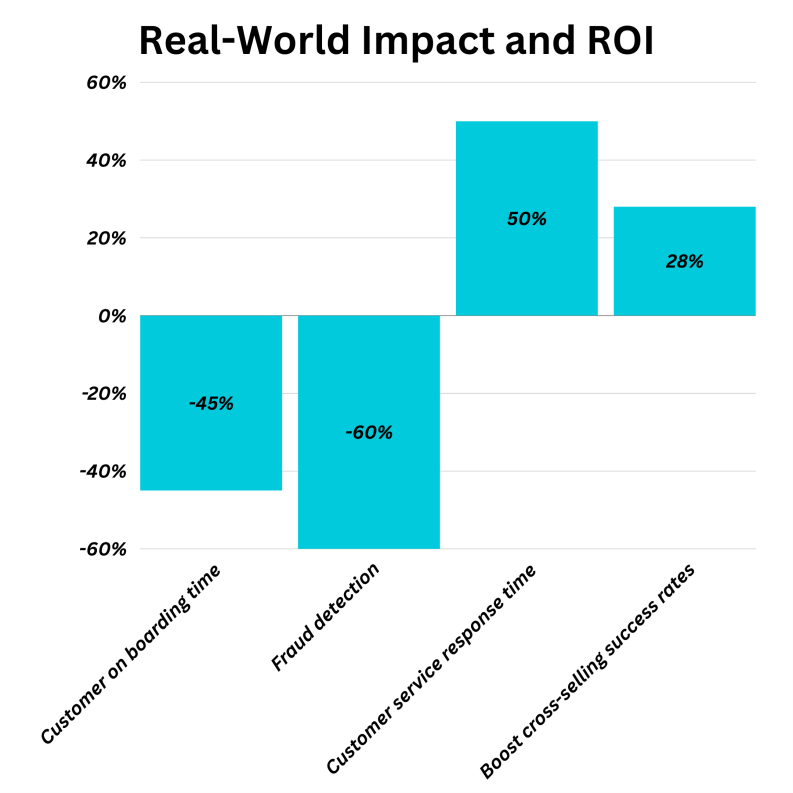

- Real-World Impact and ROI

The application of generative AI in retail banking is no longer about the sheer novelty of technology, but truly business results that can be measured:

- Customer on boarding time will reduce

- 60% decline in false positives fraud detection

- 80% improvement in customer service response time

- 28% boost in cross-selling success rates

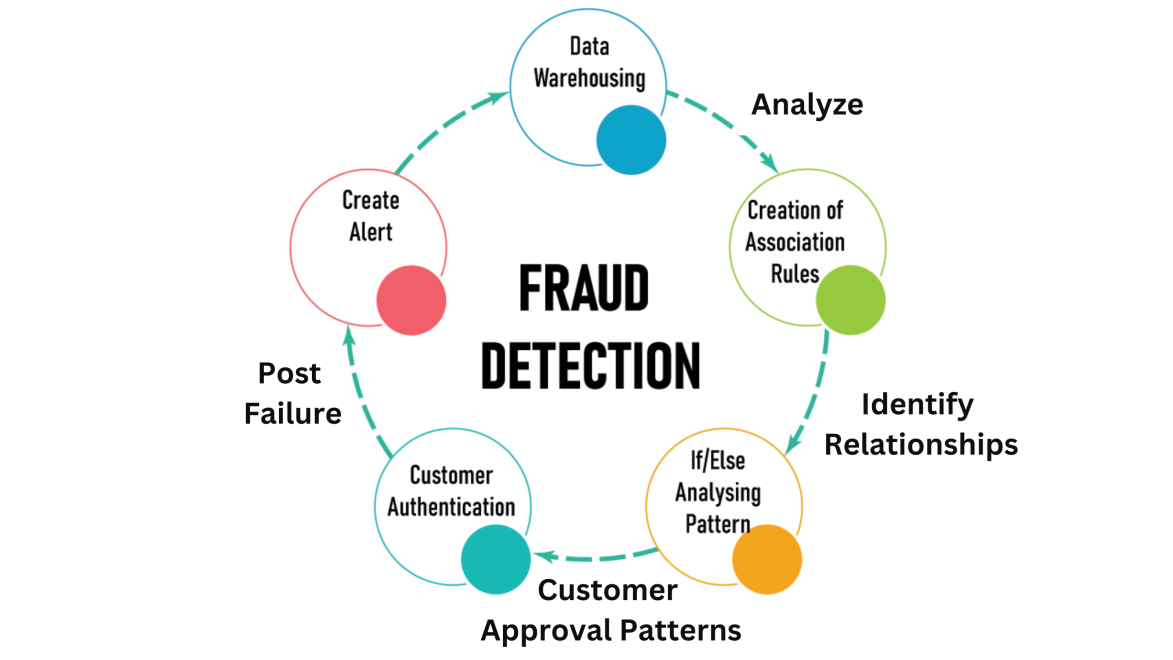

- Fraud Detection and Prevention

Generative AI models can allow a bank to better predict fraudulent activities by checking the patterns of transactions and discovering unusual behavior.

Automating the initial phases of fraud detection allows a bank to utilize its resources more effectively. Analysts can then focus on more challenging cases that require human judgment and expertise, which results in the efficient workflow of the organization, allowing less time and effort to be spent reviewing and investigating manually.

For example, an AI system can learn from historical fraud data and improve its predictions over time with enhanced fraud detection accuracy as well as operational efficiency.

The Future of AI in Banking

The advancements made in generative AI technology will assure even more innovative applications in retail banking. Among the most encouraging emergent developments is the use of unconventional data sources for the generation of credit scoring models powered by artificial intelligence.

Credit scoring is usually biased towards historical financial data, thereby excluding large chunks of potential customers who may not have the credit history to describe themselves.

Advanced models which factor in alternative data, such as social media activity, transaction patterns, and even some insights into behavior, can thus offer a much richer view of a customer’s creditworthiness.

This represents a totally new dimension in the retail banking area through the integration of credit scoring and generative AI using unconventional data sources.

More and more financial institutions are likely to adopt these new trends for improving their knowledge in assessing the creditworthiness of customers, financial inclusion, and a fairer marketplace.

As this trend continues evolving, it will be important for the banks to balance technological advancements with an ethical consideration so that innovations may benefit all.

In summary, the new panorama for retail banking in using generative AI would redefine the face of financial services with the power of advanced analytics and machine learning.